Slides – This is from a one hour presentation we did on the asset allocation model

Spreadsheet – this can be used to create your asset allocation model

Asset allocation is an approach where investments are made across a range of classes of assets in order to diversify and not have all your eggs in one basket.

Various asset classes perform differently to other asset classes. When equity markets rise, it doesn’t mean that government bonds rise or gold rises. Therefore to spread risk, its better to be invested across a range of assets. But the question is what assets and what % in each.

Relative strength is another key principle. This is a measure of how much one asset compares or relates to, another asset with regard to performance. We use this to decide what asset to be invested in versus another asset at a particular period in time. In our case, where we have ten assets that we could be invested in, we’d prefer to be in the top performing 3 or 4 and not all ten. This gives us much better performance. We say that we’re invested in the top ranked assets.

How do we decide what asset is “ranked” higher than another asset?

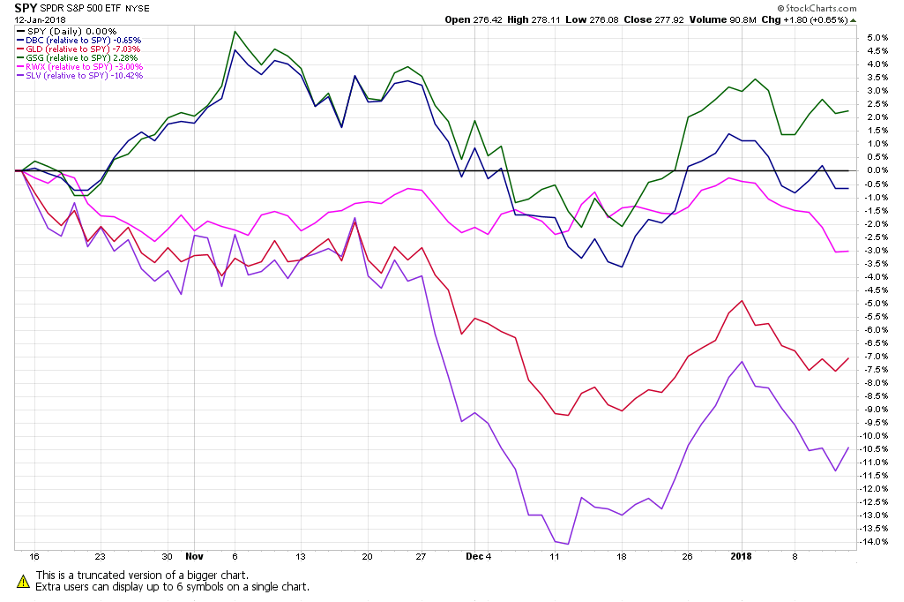

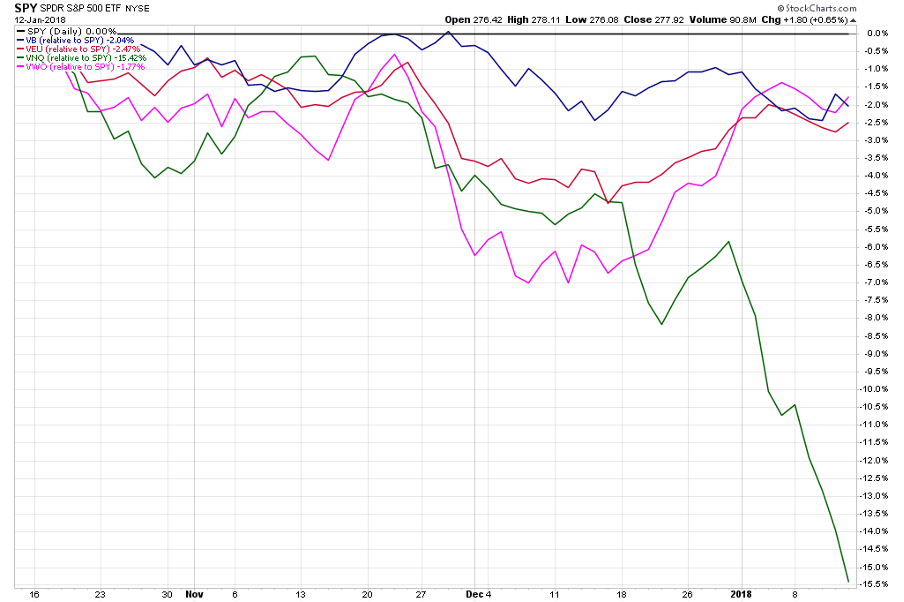

I use Stockcharts.com and compare the instruments to the SPY (S&P 500 index). Then its an easy visual to see what is outperforming each other. I look at the prior 3 months data only. SPY is the black flat line and the other instruments are different colors.

So below we see that: VWO, VEU, VB & DBC – along with SPY are the top performers recently. So we’d allocate 20-25% of our Growth allocation into these right now.

Leverage or Margin is the amount of buying power we have compared to our cash value. If we start with $100,000 cash, then with most broker accounts, we have the ability to “borrow” and invest more than $100,000. The interest is close to zero, which makes this quite attractive. The downside is that when our portfolio is valued at less than $100,000 we may get asked to add more cash to balance things out. In our case, we’re going to use 2:1 leverage which is very conservative and will be watching all the time to ensure that we don’t have to top anything up. In some markets, like futures or forex, the leverage is 50:1 or 100:1 by default. Meaning that we’d need to watch this like a hawk. So we stay out of those markets.

Re-balancing is when we take profits from gains in the month and re-allocate to the other categories. This can be called dollar-cost-averaging but its most useful to ensure that we’re growing our Security bucket.

Our Model

We start with the approach that to be conservative, we’re going to allocate our funds across three broad categories of assets: Security (safe, slow moving assets), Growth (medium risk, faster moving assets) and Momentum (higher risk assets).

Using a financial planners approach, we allocate a certain % to each broad category based on risk profile. The easiest way is to consider our ages. Younger people have longer working so they can be more risky – oldies need more into security. Etc. The following is based on 50+ year olds. A good rule of thumb is make Security category close to your age in %. Then even split the other two.

Security = 50%, Growth = 25%, Momentum = 25%

Security Assets

These are typically cash based, government bonds (given that you think governments are trustworthy!).

Growth Assets

These are equities, real estate, some company bonds, etc. I’m using ETF for each of these, so we don’t have to invest in individual stocks, we can cover each asset class with one ETF. The less investment instruments means less commissions.

Momentum Assets

Here we’re looking for real performing assets, but they may be more volatile. Crypto-currencies, option strategies, futures contracts, etc. Again, where possible, we’re using ETF.

Rules

Once we get started, then we stick to the following rules. This removes bias and emotion and just lets the investments do their thing.

- Re-balance on the 15th of every month. We sell down profitable assets and re-invest the funds back into the major categories.

- Don’t invest in any asset that is trading below its 10 month moving average. This is usually taken care of by only trading assets that are ranked in the top 4 for its category. And move its allocation into Security.